Alternative data has gained popularity amongst financial institutions, FMCG companies, marketers and tourism companies. Even though this form of new data opens up new complexities and challenges when it comes to making sense of this data, it does give an “edge” to industries that aim to leverage its use.

Whether for targeted marketing, credit score calculation, or geopolitical prediction, alternative data brings new promises and excitement to these industries that earlier relied on static data.

Data analysts have traditionally used data from sources such sales figures, SEC filings, financial statements, consumer surveys and hotel bookings to identify patterns and make decisions. Even though data from these sources is valuable, it does not give a complete or timely picture. Decision makers in the current data-driven environment seek more actionable and relevant insights before making inferences.

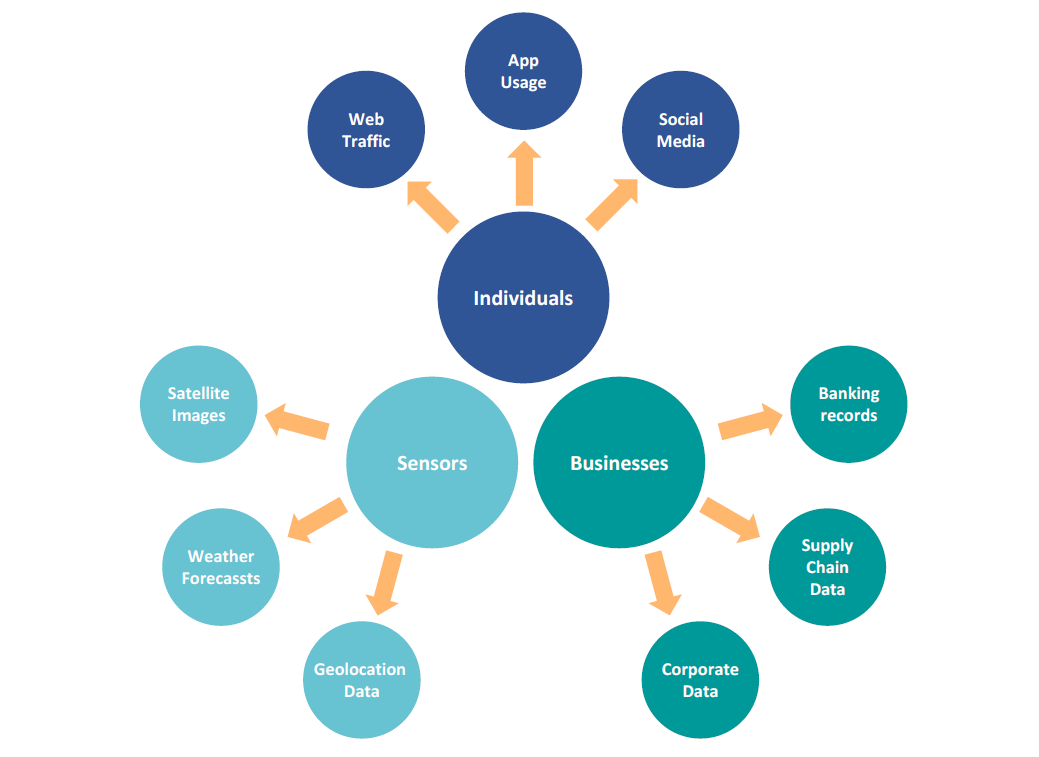

This is where data from non-traditional sources comes into the picture. These sources could include:

- web traffic / searches

- mobile device or location data

- satellite photos

- public records

- news

- social media feeds

- financial transactions and even sensor inputs

More often than not, these sources are external to the companies that are under analysis.

This alternative data gives decision makers a set of unique and timely insights, that if properly extracted can help predict events or patterns that lead to a future outcome.

Early sources of alternative data consisted of credit card transactions, web scraped data, geo-location data from cellphones, satellite images and weather forecasts. However, recent regulations such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and other privacy constraints have raised concerns about some of these sources. Thus, the data aggregators and end-users need regulatory compliance, which ensures their datasets are free from Personal Identifiable Information (PII).

A new source of alternative data that is rapidly gaining traction is data gathered directly from consumers in a scientific and compliant manner. This data goes beyond a simple card swipe and evaluates the motivations and intentions of the consumers who use their cards. This type of data has seen success in predicting sales, economic signals such as recessions and future purchase intentions across categories such as flight tickets, hotel reservations and impulse buyers.

Alternative data is appealing because it is openly available, and in many cases free for the taking.

For instance, the amount of global data generated is expected to reach 175 Zeta Bytes by 20251. This means more data to feed Artificial Intelligence (AI) tools, more potential patterns and trends to discover and more possibilities of gaining an edge over competitors.

Furthermore, due to COVID-19, there has been a greater shift towards online activities and a digital marketplace that is driving banks, ecommerce companies, retailers and investors to turn to alternative data as a source for decision making. This type of data can provide a close to real-time picture that lets institutions come to timely decisions about risk management, loans, spending patterns and so on.

Sources and types of Alternative Data in today’s age2

- 1

IDC: https://tenderalpha.com/blog/post/quantitative-analysis/alternative-data-market-overview

- 2 Pinebridge investments insights: https://www.pinebridge.com/en/insights/using-alternative-data-wisely-notblindly