Economic dynamics in 2019 will be, more than ever, correlated to political events and market volatility. However, technology will continue to play a fundamental role in the growth of the global economy today and the development of our society tomorrow, despite the financial market turmoil caused by political headwinds.

In 2019, along these lines, we believe technological disruptive innovations such as Artificial Intelligence, IoT, Machine Learning or Robotics will act as the accelerator for growth across all sectors.

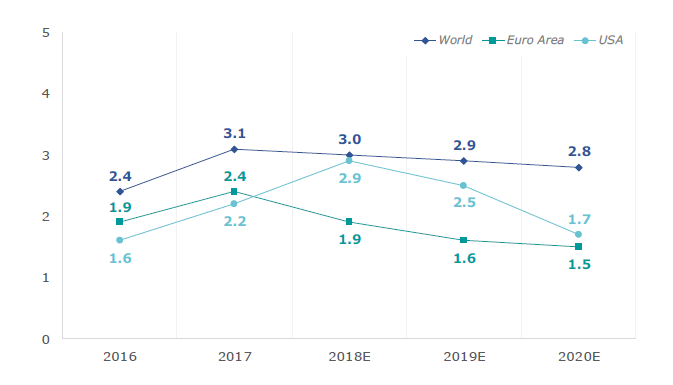

From a top-down macro perspective, the global M&A ecosystem should remain healthy. In most developed economies, monetary policy remains fairly loose compared to the pre-crisis levels. This suggests further moderate stabilisation in 2019 despite a likely rise in inflation and consequent rate hikes in the US and probably in the Euro area later in 2019.

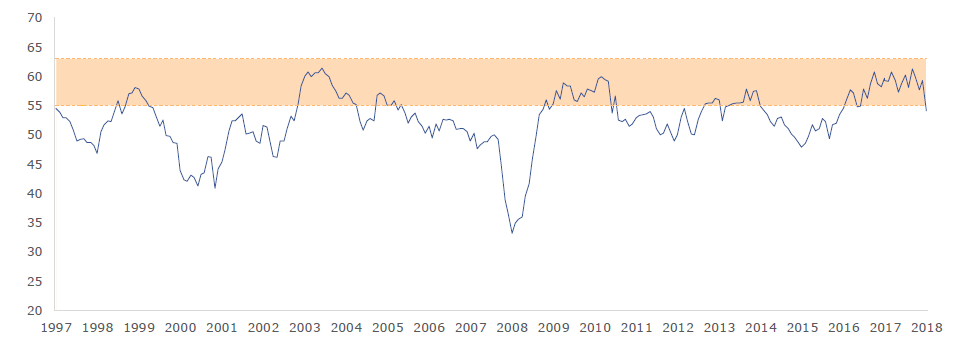

However, even the most promising economic expansions eventually turn into slowdowns. As shown in Figure 3, the global manufacturing PMI Index has recently fallen from its historic highs, and this is typically followed by more moderate growth rates for the subsequent 6-12 months. This indicator suggests that the current economic environment is likely to experience a weakening in growth rates, with increased volatility, compared to the previous “boom”. This expected slowdown in economic activity in 2019 is supported by the independent macroeconomic consultancy Rosa & Roubini Associates.